Is amazon flex 1099.

How much $$$ you made with Flex in 2021? Just loaded my 1099-NEC form from Amazon. It says I made $50,016. It was my second job. Seattle area. My min pay was $36 for 2 hours. My max was $275 for 5 hours. I made 40k+ miles on the roads for the last year. Got broken windshield glass and flat tire.

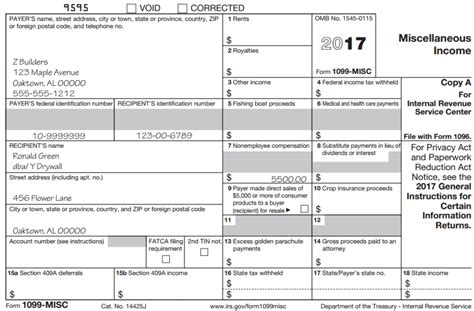

As an independent contractor or freelancer for Amazon Flex, getting your 1099 form is crucial for filing your taxes accurately. Without this form, you may not be able to report your income correctly, which can result in penalties and fees. Additionally, having your 1099 form on hand makes it easier to keep track of your earnings and expenses ...U.S. law requires Amazon.com to collect tax information from Associates who are U.S. citizens, U.S. residents, or U.S. corporations and certain non-U.S. individuals or entities that have taxable income in the U.S. We're obligated to have this information on file in order to make payments.Click Start across from Miscellaneous Income, 1099-A, 1099-C. On the next screen, Let's Work on Any Miscellaneous Income, click Start across from Hobby income and expenses. Enter your information. The 1099-NEC you received from Amazon is an important document, but only you can determine how such income should be characterized.When will I receive a 1099 form? Why do I have to take the online tax interview? How do I sign a form electronically? Do I have a tax liability? What is a U.S. Tax Identification …

If you need your 1099 or need to update any personal information on your 1099, you will need to reach out to the platform you work for. We’ve collected this list of resources from a few of our partners. Amazon Flex. Doordash. Grubhub. Favor Delivery. Instacart. Shipt. Uber/Postmates. Please note that several of our partners use Stripe to …If you exceeded the $10 global royalty payment threshold across all Amazon businesses, you will be subject to IRS Form 1099-MISC reporting. Payments to corporations, including limited liability companies (LLCs) that are treated as C- or S- Corporations, and certain tax-exempt organizations are not reportable on Form 1099-MISC. Non-U.S. publishers.If you earn over $600 in the respective tax year you will have the 1099-MISC tax form issued to you by Amazon. Auto insurance is the only form of insurance provided to you as an Amazon Flex employee. Amazon requires you to have and maintain personal auto insurance but the company also provides you with Amazon Commercial Auto …

Amazon Flex calls a shift a “ delivery block “. To get scheduled into Amazon Flex blocks, you simply go into the app to see the available times. Amazon Flex allows you to schedule full-time or part-time shifts. This can allow you to fit delivery work around your family or additional jobs that you work.

Hello, I'm wondering which section on Turbo Tax I file the below information. In 2021 I earned money via: Amazon Flex Doordash Mercari Construction Worker (1099) The company I worked as a construction worker for did not provide a 1099 but I only worked for 3 days and I know the gross amount I made...Have you ever wondered how the unbelievably rich and successful founder of Amazon came to be the person he is today? The story behind Jeff Bezos and the making of Amazon is certainly an interesting one.The easiest way to get your Amazon Flex 1099 is to download it from your Amazon Flex account online. The Amazon Flex 1099 includes your earnings for the year, any bonuses or incentives you received, and any taxes that were withheld. Amazon Flex typically sends out 1099s by January 31st of each year.If your gross payment volume for a calendar year exceeds $20,000 and you have more than 200 transactions in that same year across all your Amazon Payments, Amazon Webstore and Selling on Amazon Accounts, you will get a copy of a Form 1099-K from Amazon Payments early in the following year.

Health department tulsa ok food handlers permit

Here is the link to the IRS webpage that discusses 1099-Misc, Independent Contractors and the Self Employed from which the above quote was obtained. You might find this information helpful. Also included below is a link to the IRS' business activity codes. 1099 Misc, Independent Contractors and Self Employed . IRS Business Activity Codes ...

Step #1: Stay calm. Don’t worry too much about not receiving a 1099-NEC or 1099-K. It can be annoying not to get a form when you're supposed to, especially if you did everything right — keeping your address up to date and opening a separate PayPal account for your business.1099 Contractor. The IRS is very strict when it comes to tax reports. That’s why it is essential to know what form you need to get in each tax season. ... Is Amazon Flex lucrative enough to become a full-time occupation? There’s no right way to answer this question, but it all depends on the individual’s needs. For example, if you have ...On the Spark Driver app, you have the freedom and flexibility to earn whenever it's convenient for you. Enjoy even more ways to earn Make the most out of every trip. Available in more than 3650 cities and all 50 states, the Spark Driver app makes it possible for you to reach thousands of customers. Deliver groceries, food, home goods, and more!Make quicker progress toward your goals by driving and earning with Amazon Flex.Customers. If you’re an Amazon Flex customer anxiously awaiting a package, there’s one phone number you need to know. Call 1-877-212-6150 to reach customer support regarding a pending order or pending delivery. The Amazon Flex support team is great when it comes to dealing with immediate issues regarding package deliveries.

When it comes to choosing a payment gateway for your online business, there are many options available. One of the most popular options is Amazon Payment. In this article, we will compare Amazon Payment with other payment gateways and help ...Amazon has begun to pay around $60 million to Amazon Flex delivery drivers to meet the terms of a settlement with ... alongside an IRS 1099 form and a requirement that they report the payment as ...Amazon has to report at $600. You have to pay SE tax at $400 of net profit. You have to report for income tax purposes if total income > $12,550, even if this is say $12,500 in W-2 income and $100 in Flex income.Amazon has to report at $600. You have to pay SE tax at $400 of net profit. You have to report for income tax purposes if total income > $12,550, even if this is say $12,500 in W-2 income and $100 in Flex income.Amazon has begun to pay around $60 million to Amazon Flex delivery drivers to meet the terms of a settlement with ... alongside an IRS 1099 form and a requirement that they report the payment as ...

The Amazon Flex app also provides safety videos, articles, and information on pet safety support on how to stay safe when a dog and pet is present. Optimized maps: Amazon Flex maps helps you navigate and shows known speed limits, road closure alerts, and live traffic conditions, so you can choose which route to take. The Amazon Flex app also provides safety videos, articles, and information on pet safety support on how to stay safe when a dog and pet is present. Optimized maps: Amazon Flex maps helps you navigate and shows known speed limits, road closure alerts, and live traffic conditions, so you can choose which route to take.

The Amazon Flex app also provides safety videos, articles, and information on pet safety support on how to stay safe when a dog and pet is present. Optimized maps: Amazon Flex maps helps you navigate and shows known speed limits, road closure alerts, and live traffic conditions, so you can choose which route to take. As businesses are scaling down and resizing following the COVID-19 pandemic, the gig economy is exploding as many of us turn to freelance work and independent contracting. In a gig economy, temporary and flexible jobs are commonplace.I first got involved with making money outside of a traditional 9-5 job through Amazon Flex, which I have documented extensively on this website. In hindsight, it was a great way to make some extra cash, and I enjoyed the challenge of efficiently completing deliveries for customers. ... Amazon Flex 1099 forms, Schedule C, SE ©2021 MoneyPixels ...Amazon Flex driver. Artist. Athlete. Attorney. Audio engineer. Beekeeper. Blogger. Brewer. Car rental provider. Caterer. Chauffeur. Chef. Childcare provider. Chiropractor. ... The Last Uber 1099 Tax Guide You'll Ever Need. How To File Your DoorDash 1099 Taxes: Everything You Need to Know. How To Handle eBay Taxes the Right Way in 2023.Independent Contractor at Amazon. I enjoy working as a Flex Driver for Amazon overall. I really really love the flexibility along with the better than usual pay as an independent contractor. It’s the perfect side hustle for me, but it can also be made as full time it’s full-filing ones financial needs.Not every Amazon seller gets a 1099-K form from Amazon. To meet the requirements for a 1099-K, you must have both $20,000 in total sales, and 200 individual transactions. However, if you have at least 50 transactions, you still need to provide your tax status to Amazon. If you don’t, you risk losing your ability to sell on the platform.2] Sign up on the Amazon Flex website or download the Flex app, create an Amazon account or sign in if you already have one; follow the instructions and provide …

Unblocked games on google

How to find your Amazon Flex 1099 form. Amazon Flex drivers can download a digital copy of their 1099-NEC from taxcentral.amazon.com. What to do if you don't get a 1099 from Amazon. Not all drivers are supposed to get a 1099-NEC. If you earned less than $600 in Amazon Flex income — say, if you … See moreDoninGA. Level 15. No you do not need to be an LLC. You can report your self-employment income and expenses on a Schedule C using your own Social Security number. Schedule C is included with and part of your personal tax return, Form 1040. December 12, 2019 11:57 AM. 0.How do you get your Amazon Flex 1099 tax form? You can find your Form 1099-NEC in Amazon Tax Central. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st. NEC stands for nonemployee compensation.This is the "non-employee compensation" 1099 shape you receive by Amazon Flex if you earn for least $600 with them (if it is under $600, you will not receive …This means that you are self-employed and will receive a 1099 form for your tax filing. (Currently, a 1099 form will be sent for earnings over $600.) As others have suggested, use an app like Stride, MileIQ, or QuickBooks Self-Employed to keep track of your mileage. The standard mileage deduction is the best way for most 1099 filers. © 1999-2023, Amazon.com, Inc. or its affiliates ...1099-NEC EIN Number. Can anyone please comment what the EIN number is on the new 1099-NEC. I have my total wages but can’t access the tax central website. Every time I call the support number they can’t seem to understand I’m trying to access my tax forms and not my old Amazon account and can’t restore access. This thread is archived.Learn about the latest tax news and year-round tips to maximize your refund. Check it out. The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Amazon is one of the largest e-commerce platforms in the world, making it a prime destination for online sellers looking to increase their sales. One of the most important tools available to sellers on Amazon is their My Account page.I'm trying to finish up my taxes. I never got my 1099 from Amazon but I did get my W2's. I went to tax central to download a copy and it says no file to download. I've been back and forth with flex support and they keep sending the same fucking form answer and not listening. I can go to download it, it says no files found!According to Amazon Flex, every driver is responsible to obey tax laws and to determine their own tax obligations. This means that you are responsible to declare your income to the German tax office and pay income tax for the money you make via Amazon Flex, if the total sum of your income exceeds the tax free threshold of 9,744€ (as of 2021).Organization Profile. Amazon Com Inc is a corporation in Seattle, Washington. The employer identification number (EIN) for Amazon Com Inc is 911646860. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. It is one of the corporates which submit 10-K filings with the SEC.We will issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Generally, payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive ...

Make quicker progress toward your goals by driving and earning with Amazon Flex.Tax form 1099-NEC . ... Related Topics Amazon FAANG Online shopping S&P 500 Consumer discretionary sector Marketplace and Deals Marketplace Business Website Finance Business, Economics, and Finance Information & communications technology ... I see we post flex route pictures here.Pay up. 4. Tax on $600 is nothing and after expenses (mileage deduction) plus your personal deduction , you likely will not pay anything any way. The $600 rule is no longer a thing, the IRS changed the ruling. THEY, meaning Amazon, do not HAVE to report it to the IRS. If you exceeded the $10 global royalty payment threshold across all Amazon businesses, you will be subject to IRS Form 1099-MISC reporting. Payments to corporations, including limited liability companies (LLCs) that are treated as C- or S- Corporations, and certain tax-exempt organizations are not reportable on Form 1099-MISC. Non-U.S. publishers. 930 pm est If you need your 1099 or need to update any personal information on your 1099, you will need to reach out to the platform you work for. We’ve collected this list of resources from a few of our partners. Amazon Flex. Doordash. Grubhub. Favor Delivery. Instacart. Shipt. Uber/Postmates. Please note that several of our partners use Stripe to …Your guide to Amazon Flex offers. With Amazon Flex, you can earn on your terms with offer types that fit your life and goals. Most drivers earn $18-$25 an hour, and there are two main ways to earn with Amazon Flex: “blocks” that you can schedule in advance, and “instant offers,” which are deliveries that start right away. uc davis department of surgery Download the Amazon Flex app. Becoming an Amazon Flex delivery driver is easy. Simply scan the QR code on the right using your iPhone or Android camera, and you will be directed to the download process. Multi Drop Delivery Driver (Current Employee) - Lutterworth - October 16, 2023. Too many drop per say 160-180. Too much stress and pressure. Starting 10-11am finish 7-9 pm. Poor management. Hardest part of job is dealing with other drivers leaving bottles of urine in van and too many parcels (300 per day) Cons. grand theft auto 6 wikipedia Understanding the Amazon 1099-k. The revenue figures you see on your Amazon 1099 report is the total of the following: To track down these numbers, you simply need to download your account's date range transactions report. 1. Click Payments on your Reports tab. 2. Select Date Range Reports on your Payments page. 3.If your gross payment volume for a calendar year exceeds $20,000 and you have more than 200 transactions in that same year across all your Amazon Payments, Amazon Webstore and Selling on Amazon Accounts, you will get a copy of a Form 1099-K from Amazon Payments early in the following year. oreilys columbus ms Pay up. 4. Tax on $600 is nothing and after expenses (mileage deduction) plus your personal deduction , you likely will not pay anything any way. The $600 rule is no longer a thing, the IRS changed the ruling. THEY, meaning Amazon, do not HAVE to …Step #2. Get your 1099 forms. If you earned at least $600 during the tax year, Postmates should send you a 1099 form documenting how much you earned on the platform. You can expect to receive this form around January 31st. Don’t worry — we’ll cover what a 1099 is and how to use it when you file your taxes in a moment. in doing this synonym Here is the link to the IRS webpage that discusses 1099-Misc, Independent Contractors and the Self Employed from which the above quote was obtained. You might find this information helpful. Also included below is a link to the IRS' business activity codes. 1099 Misc, Independent Contractors and Self Employed . IRS Business Activity Codes ...Flex Seal products are available on Flex Seal’s official website and in many major big-box stores. A store locator on the Flex Seal website lists over 100 stores that carry the liquid rubber sealant coating as of 2015. pet simulator x dlc DoninGA. Level 15. No you do not need to be an LLC. You can report your self-employment income and expenses on a Schedule C using your own Social Security number. Schedule C is included with and part of your personal tax return, Form 1040. December 12, 2019 11:57 AM. 0. supra gear ratio car parking Payments. Payment Setup. What payment methods are available? Changing Payment Type. Check Fee. Payment Threshold Settings. When Do Changes to Payment Preferences Take Effect? Two-Factor Authentication when accessing payment details. FAQ - Fx4Cash - International Transfers Solution.Make quicker progress toward your goals by driving and earning with Amazon Flex. Your account status appears in the “Product Status” box on the top left of the screen. If you see Active next to Amazon Pay in the Product Status box, then your tax interview has been successfully completed and you are all set to transact. If you see " REGISTRATION_INCOMPLETE ", your tax interview data is still being processed. … free nylon vids There is a system error. Please try again later. ... mary beth rule 34 Independent Contractor at Amazon. I enjoy working as a Flex Driver for Amazon overall. I really really love the flexibility along with the better than usual pay as an independent contractor. It’s the perfect side hustle for me, but it can also be made as full time it’s full-filing ones financial needs. tallahassee craigslist free Sep 12, 2023 · Use the app to request a call: In the Amazon Flex app, tap on the question mark in the top right corner to go to the Help page. Then select “Request call from support.”. You should receive a call within 30 seconds. Call Amazon directly: You can reach support by calling (877) 212-6150 or (888) 281-6901. Amazon Flex vs Amazon DSP: One is a gig, one is a full-time job. Delivering for Amazon Flex is different than delivering for Amazon Delivery Service Providers (DSP). Amazon DSPs are logistics companies that employ drivers to do deliveries. DSP drivers are full-time W2 employees who typically work 40–50 hours per week with a demanding … san diego bodyrub In today’s digital age, protecting your personal information has become more important than ever. With the increasing popularity of online shopping, many people rely on platforms like Amazon to make purchases conveniently.Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.If your gross payment volume for a calendar year exceeds $20,000 and you have more than 200 transactions in that same year across all your Amazon Payments, Amazon Webstore and Selling on Amazon Accounts, you will get a copy of a Form 1099-K from Amazon Payments early in the following year.